You are here:Home >Newsletters>Archives

MHP NEWS

March 2021

The first three quarters of the financial year are almost done. This time last year, our March newsletter was about Covid-19 and turbulent times it presented- so much has happened in a year!

March brings with it the start of interim tax planning, quarter end obligations and the end of JobKeeper payment. We cover these topics and other important ATO snippets in our March newsletter .

Tax Time 2020/2021

Tax Planning/Interims

The end of the financial year is around the corner and it's time to start thinking about tax planning.

Tax planning or interims as we often refer to it, is the evaluation of your finances from a tax perspective. The purpose being to ensure maximum tax efficiency of your business.

Factors we examine include timing of income, timing of purchases, planning expenditures or even planning for retirement.

The overall aim is to give you an idea how your business is tracking and to determine your current tax position. We can then recommend strategies to manage tax and/or give you ample notice of any tax that may be due in the future.

In preparation of interims and to assist us in planning relevant tax strategies you can start thinking about the following in the lead up to June;

- Your projected income

- Your projected expenses in the lead up to June.

- Ensuring your accounting software is reconciled to date

15 May 2021 Due Date- DEADLINE

The 15 May deadline will be here before we know it. If you have not lodged your 2020 tax return then you need to by 15 May 2021

You must lodge (and pay where applicable) your 2020 tax returns by 15 May if;

- you have not already lodged and are not eligible for the 5 June 2021 concession.

- you are a company or super fund in this group you also need to pay on this date (if required).

Note: Individuals and trusts in this category pay as advised on their notice of assessment.

If this is you, we need your tax information NOW!

Remember, the ATO imposes fees for late lodgement of your income tax returns.

Call us if you are unsure if you fit in this category, we can quickly let you know.

Upcoming Due Dates

March is the end of our third financial quarter.

Due dates to be aware of are as follows;

- Superannuation Guarantee (SG): 28 April for the quarter end 31 March

- Instalment Activity Statement (IAS) and Business Activity Statement (BAS): 21 April for the month end 31 March AND 21 May for the month end 30 April

- BAS: 28 April for quarter end 31 March

- Pay as you Go Instalment (PAYGI): 28 April for the quarter end 31 March

- Fringe Benefits Tax (FBT): Pay Fringe Benefits Annual return (lodgement due 25 June)

End of JobKeeper

The Government's JobKeeper initiative is ending. The Jobkeeper Payment Scheme extension 2 will end on 28 March 2021. Therefore your last monthly business declaration (for March) will be due by 14 April 2021.

There is no need to do anything different now the program is reaching its expiration date.

Points to note;

- If you are not currently receiving the payment and past the eligibility criteria there is still time to enroll.

- Adversely you are currently in the JobKeeper program you can opt out at any time.

http://www.ato.gov.au/.../JobKeeper.../JobKeeper-guides/

Post JobKeeper Stimulus Package

The Federal Government announced that it will roll out a stimulus package across the travel and tourism sector.

Highlights include discounted air fares and will commence 1 April this year.

The package will see a subsidy of 50% of 800,000 domestic flights to select tourist destinations across our country. Destinations include; Gold Coast, Whitsundays, Alice Springs, Broome, Kangaroo Island and Merimbula.

The outcome is to get Australians travelling to support tourism operators, businesses, travel agents and other related industries/businesses who continue to do it tough through COVID-29 with international boarders still closed.

Small Medium Enterprise Loan Scheme Expanded

Another post JobKeeper announcement by the Federal Government sees an expansion to the Small Medium Enterprise (SME) Loan Scheme.

The limit of eligible loans will rise from $1 million to $5 million under the scheme. This announcement also comes with a cost split shift which will see the government guarantee a higher portion of the loan. The shift would see the government's 50-50 split with banks shift to an 80-20 split.

The expanded scheme will only be open to recipients of JobKeeper payments between 4 January and 28 March and those that applied during part one of the scheme. These loans will be available from 1 April 2021 and close 31 December 2021.

Always seek advice from us before entering into a SME Loan Agreement.

More in depth information about the expansion of the SME Loan Scheme is available here;

https://treasury.gov.au/coronavirus/sme-recovery-loan-scheme

FBT Season

The Fringe Benefits Tax (FBT) year is wrapping up and ends on 31 March 2021. If you provide or receive Fringe Benefits then there are a few things you need to remember.

If you provide Fringe Benefits to employees, your FBT Return (and payment where applicable) is due by 21 May 2021 (if you lodge through us the date for lodgement is 25 June 2021).

Examples of fringe benefits include, private use of cars, entertainment, reimbursement of employees expenses or salary sacrifice arrangements.

If you receive a fringe benefit(s) from your employer and the value of the reportable fringe benefits provided to you exceeds $2,000 in a fringe benefit tax year then you need to report it. Your employer is required to report this on your income statement. It is not included in your total income nor do you pay income tax or Medicare levy on it. It is used for calculating and determining things like your entitlement to the private health insurance rebate and your eligibility for particular tax offsets.

If you receive a fringe benefit for a work vehicle, remember to get your odometer readings, set up new log books and get declarations of use of work utes etc.

for more information on Fringe Benefits Tax, click on the ATO link below and contact us for assistance.

https://www.ato.gov.au/Newsroom/smallbusiness/Employers/When-is-it-a-fringe-benefit-/?sbnews20210317

ATO Quick Bits

Have you been working from home?

While you might not be able to claim your active wear (or inactive wear!), you can still claim 80c per work hour on working-from-home expenses until 30 June 2021!

All you need is a record of how many hours you've worked from home such as a timesheet, roster, diary or similar document.

For more info on claiming working-from-home expenses, visit http://www.ato.gov.au/.../deduction.../home-office-expenses/

What's New and Changing from 1 July 2021?

Super Guarantee rate to increase to 10%

On July 1 2021, the Superannuation Guarantee (SG) rate will rise from 9.5% to 10%.

So if you are a business with employees, you will need to ensure your payroll and accounting systems are updated to incorporate the increase to the superannuation rate.

The below link will provide you more information on the increase and tools to determine if your employees are eligible for super (including contractors treated as employees for super purposes).

SG will increase at a rate of 0.5% over the next 5 years to reach 12% by 1 July 2025.

https://www.ato.gov.au/Business/Business-bulletins-newsroom/Employer-information/Super-Guarantee-rate-rising-1-July/

Please also note also from 1 July 2021, where an employee does not have a superannuation fund, you can no longer set up a default fund. You will first need to contact the ATO to see if the employee has any existing superannuation funds to connect to. Only when the ATO confirms that there are no existing super funds connected to the employee, can you you use your default fund.

Company Tax Rate Reductions

From 1 July 2021, the company tax rate for base rate entities will reduce to 25%.

|

|

2020-21 |

2021-22 |

| Base rate entities* |

26% |

25% |

| Other corporate tax entities |

30% |

30% |

*aggregated turnover less than $50m and no more than 80% of the company's assessable income is base rate entity passive income.

Single Touch Payroll (STP)

From July 2021 Single Touch Payroll (STP) will apply to most businesses. This will now include small businesses (those with fewer than 19 employees) and business with closely held employees ie directors of family companies, salary and wages for family employees of a business).No further extensions will be granted.

However, employers with closely held employees, some concessions on how you report is being offered. Employers in this category can report in actual real time, report actual payments quarterly or report a reasonable estimate quarterly.

If you fit in to this category and need assistance please contact us to assist you with the transition.

Superannuation Concessional & Non-Concessional Contribution Caps

From July 2021, the superannuation contribution caps will increase. This means you are able to contribute more to your superannuation fund (as long as you have not already reached your cap).

The concessional contribution cap will increase from $25,000 to $27,500.

A reminder that concessional contributions are contributions made to your superannuation fund before tax (like superannuation guarantee).

The non-concessional cap will increase from $100,000 to $110,000. Remember, non concessional contributions are after tax contributions made to your superannuation fund.

The 'bring forward' rule allows those under 65 years to contribute three years worth of non-concessional contributions to their superannuation fund in one year. So, from July, people in this category can contribute up to $330,000 in one year (Superannuation balance rules will apply).

Federal Budget Summary

As the 2020/2021 budget was only released in October last year due to the Covid-19 crisis, so the 2021/2022 budget release was slim.

The 2021/2022 budget is focused around continuing Australia's recovery from Covid-19 and its economic impacts.

The following are some of the budget items most relevant to you in the tax and accounting world.

Personal Income Tax Changes

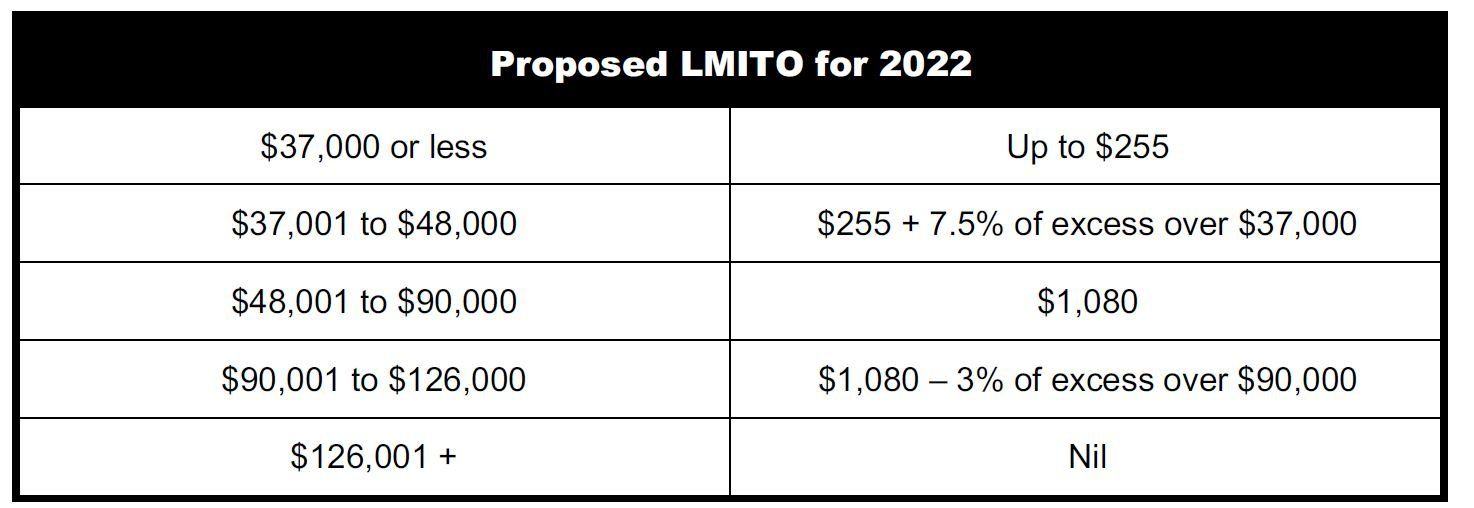

Low and Middle Income Tax Offset (LMITO)

The Government has proposed it will retain the LMITO for one more income year. Therefore, it will be available for the 2022 income year.

The LMITO is a non-refundable tax offset that provides relief for low and middle income taxpayers and is available in addition to the Low Income Tax Offset ('LITO').

Below are the proposed LMITO changes from the 2022 year.

Increasing the Medicare Levy Low Income Thresholds

Medicare low income thresholds for singles, families and seniors and pensioners will increase for the 21 income year as follows;

Singles threshold will increase from $22,801 to $23,226.

Family threshold will be increased from $38,874 to $39,167.

Single Seniors and pensioners threshold will increase from $36,056 to $36,705.

The family threshold for seniors and pensioners will be increased from $50,191 to $51,094.

For each dependent child or student, the family income thresholds increase by a further $3,597.

Individuals Claiming Self-Education Expense Deductions

The first $250 of a specified course or education expense (self education expense) is currently not tax deductible. The Government will remove this omission and it will apply from the income year after the date of legislation being passed.

Changes Affecting Business Tax Payers

Temporary Full Expensing Extension

Temporary full expensing that the Government announced amendments to in the last budget became law on 14 October 2020. The Government have now announced that temporary full expensing will be extended for a further 12 months.

This means that eligible businesses with aggregated annual turnover or total income of less that $5 billion can deduct the full cost of eligible depreciable assets of any value acquired from 7.30pm 6 October 2020 and first used or installed ready for use by 30 June 2023.

This can be fully deductible upfront rather than being claimed over the asset's life.

For businesses with an aggregated turnover under $50 million, the full expensing also applies to second-hand assets.

From 1 July 2023, normal depreciation rules will apply and the instant asset write-off threshold for eligible businesses will revert back to $1,000.

Temporary loss carry-back extension

The 2021/22 federal budget release also saw the extension of the loss carry back measure. Companies with aggregated turnover of less than $5 billion can carry back (utilise) tax losses from the 2021 income year to offset previously taxed profits as far back as the 2019 income year when a tax return is lodged for the 2021 income year.

Superannuation Related Changes

Removing the $450 per Month Threshold Superannuation Guarantee eligibility.

Currently employees need to earn $450 per month to be eligible to be paid superannuation guarantee from an employer. This threshold will be removed so all employees will be paid superannuation from their employer regardless of the income earned.

This will come into effect from the start of the income year the legislation is enabled.

Financial Housekeeping for Year End

Before you roll-over your software

Before rolling over your accounting software for the new financial year, make sure you:

- Do not perform a Payroll Year End function until you are sure that your STP finalisation declaration is correct and printed. Always perform a payroll back-up before you roll over the year.

Employee reporting

Single touch payroll

Where payments to employees have been reported to the ATO through single touch payroll, a finalisation declaration generally needs to be made by 14 July 2021 for employers with 20 or more employees and 31 July 2021 for those with 19 or fewer employees.

Payment summaries do not have to be provided to employees. Instead, employees will be able to access their Income Statement through myGov.

Reportable Fringe Benefits

Where you have provided fringe benefits to your employees in excess of $2,000, you need to report the FBT grossed-up amount. This is referred to as a `Reportable Fringe Benefit Amount' (RFBA).

Do you need to do a stocktake?

Businesses that buy and sell stock generally need to do a stocktake at the end of each financial year as the increase or decrease in the value of stock is included when calculating the taxable income of your business.

If your business has an aggregated turnover below $10 million you can use the simplified trading stock rules. Under these rules, you can choose not to conduct a stocktake for tax purposes if the difference in value between the opening value of your trading stock and a reasonable estimate of the closing value of trading stock at the end of the income year is less than $5,000. You will need to record how you determined the value of trading stock on hand.

Claiming Tax Deduction for Quarter End Super payments to Employees

If you use the Small Business Superannuation Clearing House (SBSCH) and are intending to to pay your employees quarter end superannuation prior to 30 June to claim a tax deduction then you need to be aware of the following.

Payments made must be accepted by the SBSCH on or before 23rd June 2021. This allows processing time for the payments to be received by the employees superannuation funds before the end of the 20/21 income year.

ATO Focus Areas

Cryptocurrency Under the Microscope

This tax time, the ATO are putting the spotlight on cryptocurrency. The ATO are concerned that many taxpayers think their cryptocurrency gains are tax-free or only taxable when the holdings are cashed back onto Australian dollars. If you fall into this category you need to keep good records of all your cryptocurrency transactions.

If you have traded in cryptocurrency, please ensure you let us know so we can treat it appropriately in your 2021 income tax return.

Work Related Expenses- Getting it Right

Another focus area for the ATO this tax time is work related expenses. You need to get it right! If you are claiming any work related expenses, you need to remember these three very important rules:

- You spent the money and were not reimbursed

- The money you spent was directly related to earning income

- You have a record to prove your expenditure

Knowledge Shop. (May 2021). Updates. Budget 2021-22: The Balancing Act, 1-32. NTAA. (May 2021). Alerts & Updates. 2021.22 Budget Handout, 1-6.

What we need from you to prepare your tax

When gathering up your tax records at the end of the financial year, the following list is a good checklist of what we will require from you to complete your income tax returns.

Individuals:

- Income statement

- Tax statements of managed investment funds

- Interest income from banks and building societies

- Dividend statements for dividends received

- For share sales or purchases, the purchase and sale contract notes

- For real estate sales or purchases, the solicitor's correspondence for the purchase and sale

- Rental property statements from real estate agent and details of other expenditure incurred

- Work related expenses

- Self-education expenses

- Travel expenses

- Donations to charities

- Health insurance and rebate entitlement

- Family Tax Benefits received

- Commonwealth assistance notices

- IAS statements or details of PAYG Instalments paid

- Details of any transactions involving cryptocurrency (e.g., Bitcoin)

- Details of any income derived from participating in the sharing economy (e.g., Uber driving, rent from AirBNB, jobs completed through Airtasker etc.,)

Business:

- Accounts data file (MYOB, Quickbooks, access to Xero)

- Debtors & creditors reconciliation

- Stocktake if applicable (or, if your business is a Small Business Entity, use the simplified trading stock rules mentioned)

- 30 June bank statements on all relevant loan documents

- Documents on new assets bought or sold, including the date you entered the contract and the date the asset was first used or installed ready for use

- Payroll reconciliation

- Superannuation reconciliation

- Bank statements on operating accounts

- Cash book (if applicable)

- 30 June statements on any investment or operating accounts

Please contact us for any clarification on any tax matters or issues pertaining to your individual circumstances.

Be sure to check out the links below and keep up to date with the due dates for your tax obligations.

See you in September 2021

Kind Regards

The Team

McDonnell Hume Partners