You are here:Home >Newsletters>Archives

MHP NEWS

June 2019

We are approaching the end of the 2019 tax year so, it's time to get your tax records sorted and start the new financial year on the right foot.

If any of your individual or business circumstances are changing from 1 July, be sure to let us know so we can assist you to meet all your necessary obligations and ensure you start the year organised and prepared.

Tax Time 2018/2019

Tax Time Processing

We are ready to hit the ground running! Come 1 July we will be ready to start processing your 2019 tax returns. So get your tax paperwork together and tick it off your to do list!

The ATO have also advised that they will start processing any lodged returns by 5 July and they expect to start issuing tax refunds by 16 July.

Protect your Super-IMPORTANT UPDATE

If you hold insurance inside any of your superannuation policies then you MUST read ahead.

New Government legislation has been passed that now requires you to 'opt in' by 1 July 2019 with your retail or industry super provider to retain any insurances you have through your policy.

If your super account has been inactive (has not received a contribution or rollover) for the past 16 months, the superannuation provider is now required by law to cancel the insurance cover.

If you wish to keep this insurance cover within your superannuation you must 'opt in' to maintain your insurance.

If this is something you think may affect you please contact your superannuation provider if you have not heard from them already.

Single Touch Payroll (STP) Starts 1 July- are you ready?

As you are now most likely aware Single Touch Payroll (STP) will be required for all employers from 1 July 2019.

This means that from 1 July 2019 each and every payroll you process, you need to report the details of the your employees tax and super to the ATO from your accounting software.

If you have payroll software you need to talk to your software provider to find out if your product is ready. If you don't have a payroll software solution, give us a call to assist you be STP ready.

With STP you need to;

- Pay your employees as normal and issue a payslip

- Use your STP enabled payroll software to send a report to the ATO which includes details of salaries, wages and PAYGW and super.

The process of reporting payroll information to the ATO differs slightly between software providers. If you are unsure of how your software utilises STP then you will need to contact them for instructions or training. Alternative we can assist.

With STP, employers will no longer need to complete payment summaries and group certificates at the end of the financial year. It will be reported to the ATO every time you pay your employees. And employees are able to access this information through their myGOv in real time.

Minimum Wage Set to Increase

The Fair Work Commission has announced a 3.0% increase to minimum wages.

This comes into effect from the first pay period starting on or after 1 July 2019.

This increase applies to employees that get that pay rates from the National Minimum Wage or a Modern Award and employees who aren't covered by an award or agreement.

The new national minimum wage will be $740.80 per week or $19.49 per hour.

For more information pertaining to these new changes and whether they will affect your employees please visit the Fair Work website below.

End of FY Reminders for Employers:

- Before you process your first payroll for the new financial year you should check that you have the latest tax table information. Check with your software provider for the latest information concerning the new tax tables.

- Pay as you go Withholding Payment Summaries need to be issued to your employees by 14 July 2019.

- Send the Australian Taxation Office (ATO) a PAYG payment summary annual report by 14 August 2019. Sending it earlier makes it easier for your employees to lodge their tax returns as the ATO uses this information to pre-fill their tax returns.

NOTE: If you're already reporting payments via Single Touch Payroll (STP), you'll no longer need to provide employees with a payment summary or lodge a payment summary annual report. Instead, you'll need to submit a 'finalised declaration' through your STP-enabled solution by 31 July.

- Payment Summary Statements and Payment Summaries to be sent to the ATO by 14 August 2019

Proposed changes to Low/Middle Tax Offset

You may have recently heard the buzz surrounding the low and middle income tax offset.

While this proposed change has not yet been made law, the ATO have indicated that they will start amending clients 2018-2019 assessments to add any additional credits you might be due. The ATO will action this automatically- Great news!

A summary of the proposed changes from the 2018-2019 income year as per the ATO are listed below;

- Increase the low and middle income tax offset from a maximum amount of $530 to $1,080 per annum and increase the base amount from $200 to $255 per annum.

- Taxpayers with a taxable income which does not exceed $37,000 will receive a low and middle income tax offset of up to $255

- Taxpayers with a taxable income which exceeds $37,000 but is not more than $48,000 will receive $255, plus an amount equal to 7.5 per cent to the maximum offset of $1,080

- Taxpayers with a taxable income which exceeds $48,000 but is not more than $90,000 will be eligible for the maximum low and middle income tax offset of $1,080

- Taxpayers with a taxable income which exceeds $90,000 but is not more than $126,000 will be eligible for a low and middle income tax offset of $1,080, less an amount equal to 3 per cent of the excess.

ATO QUICK BITS

Working from home?

You may be able to claim a percentage of your home office expenses on your tax return.

This could include deductions for:

- Office equipment

- Work related phone calls

- Internet access charges

- Heating and Cooling

- Lighting your home office

- Repairs to furniture and fittings

- Cleaning

Check what you can claim at www.ato.gov.au/…/deductions-you-can-cl…/home-office-expenses

Do you use the Small Business Super Clearing House to make super payments for your employees?

End of financial year processing due dates are fast approaching.

Did you know that superannuation payments are only considered to be paid once they are received by the super fund?

To make sure super funds receive your payments before the 30th of June (to receive the tax deduction), your payments must be received by the clearing house by close of business on 24 June 2019.

Maintenance is scheduled between 11.30pm Friday the 21st June and 7.00am Monday the 24th of June.

For more info, visit www.ato.gov.au/…/small-business-supera…/sbsch-system-status/

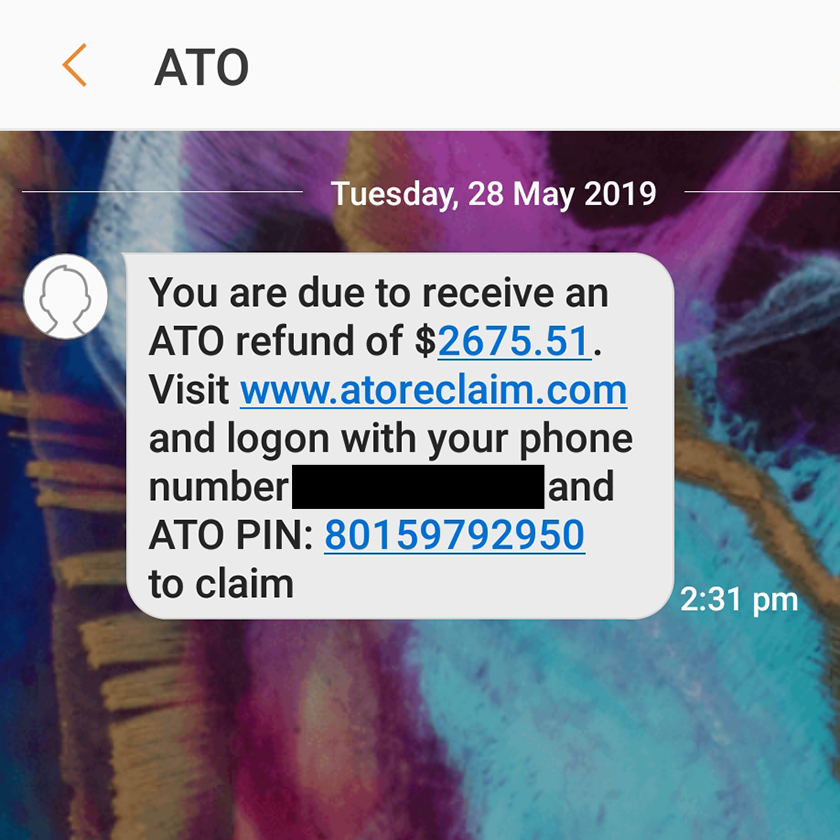

Scam Alert

The ATO has seen an increase in scam text messages (SMS) offering fake tax refunds.

These messages will usually ask you to click a link to claim a refund, and may appear to come from the 'ATO'.

• Don't click the link or anywhere in the message, even if it seems legit.

• Don't provide your personal info. We'll never ask for your details over text message.

• Warn your family and friends to watch out for this scam.

Visit our scam alerts page to learn more: www.ato.gov.au/…/Online-servi…/Identity-security/Scam-alerts

When was the last time you checked your ABN?

Inactive ABNs may be cancelled to ensure the ATO have the right information on the Australian Business Register. If you haven't used your ABN for a while (either lodging activity statements or business returns), or if your business situation has changed, the ABR Registrar may cancel your ABN.

To find out more, visit www.abr.gov.au/…/Bulk-cancellations-to-occur-for-inactive-…/

Keep pressing 'snooze' on your super accounts?

Don't worry, the ATO have you covered!

From 1 July, if you have an inactive super account with less than $6,000, your fund will let the ATO know and they'll combine it with your most active account.

For more info, visit www.ato.gov.au/…/Growi…/Inactive-low-balance-super-accounts/

Out Of Interest

Unpacking the First Home Loan Deposit Scheme (FHLDS)

Following the federal election results, the Coalition has been re-elected. In this article, MHP Private Wealth provide a brief overview of one of their new proposed measures, the First Home Loan Deposit Scheme.

The FHLDS aims to help first home buyers purchase a home faster. Estimates suggest that it will reduce the time taken for first home buyers to save for a home deposit by at least half.

Take a look at the article published by MHP Private Wealth to find out more.

https://mhpwealth.financialknowledgecentre.com.au/kcarticles.php?id=2266

A Healthy Retirement: Physical Activity and Dietary Requirements

Retirement isn't just about a healthy bank balance!

Retirement is a time to relax and enjoy the fruits of your labours; but, can relaxing too much be a bad thing? In this article published by MHP Wealth, they explore the physical activity and dietary guidelines for retirees.

When it comes to your retirement years, it's important to understand the distinction between 'life expectancy' and 'healthy life expectancy'.

Find out more on how to keep yourself fit and healthy through your retirement in this article published by MHP Private Wealth.

https://mhpwealth.financialknowledgecentre.com.au/kcarticles.php?id=2267

Please contact us for any clarification on any tax matters or issues pertaining to your individual circumstances.

Be sure to check out the links below and keep up to date with the due dates for your tax obligations.

We'll be back in August. In the mean time, an early 'Happy New Financial Year'!

Kind Regards

The Team

McDonnell Hume Partners

www.mhpartners.com.au

Key Dates

You can keep up to date with important accounting and business dates and deadlines. More...

Tax Facts

The Tax Facts section where you can learn more about tax requirements within New Zealand. More...

Calculators

Try out our new online calculators. More...

Request Appointments

You can also organise an appointment with one of our staff via our special online appointment form. This is particularly useful if you struggle to find the time during normal business hours to phone. Simply click here to book an appointment.