You are here:Home >Newsletters>Archives

MHP NEWS

August 2018

Happy New Financial Year!

It's TAX TIME! We are ready, are you!? Call now to book your appointment and get your tax return ticked off your to do list.

Keep reading for information on what we need from you to process your return-check to see you have your key records ready.

Tax Time 2018/2019

TAX TIME CHECKLISTS

Are your records ready to go? Need help on what we require to complete your return?

Find below our Individual Checklist and Rental Property Checklist. Use these as guides to assist you in ascertaining what records we require to complete your return.

NEW Rental Property Checklist.pdf

Have a Business? Be sure you include;

- Cash, online, EFTPOS, bank statements, credit or debit card transactions covering both the sales and other business income AND any expenses you can claim as a business deduction such as contractor expenses, operating expenses and business travel expenses

Sole Trader?

- Even if your income is below the threshold you still need to lodge a tax return!

Still unsure? Feel free to contact us for further information or clarification.

Tax Return Delays

Have you ever wondered why your tax return has been delayed?

While the ATO has a service commitment to tax payers, the processing of a tax return may take longer due to the flowing reasons;

- The ATO have identified some omitted income

- The ATO need to cross-check data with other government agencies like Centrelink and Child Support

- You have a debt with the ATO

- The ATO have queries about the information you provided in your return.

While we aim to process your return in a timely manner, unfortunately, sometimes tax return handling can be held up with the ATO, causing longer than the standard processing times.

To prevent your return being delayed, always provide us with true and accurate records.

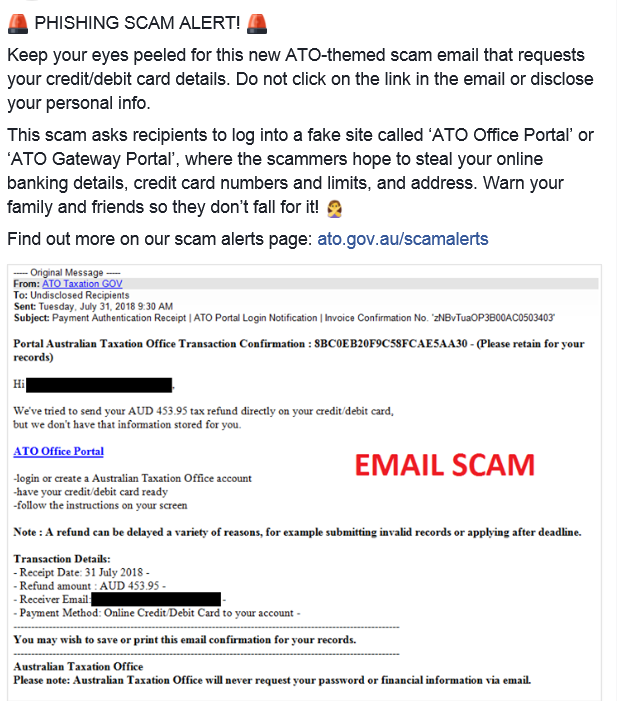

Is your Business Scam Safe?

Scams in recent times are sadly on the incline. Scammers are being increasing clever and their tactics can make us believe they are genuine.

It's important to have your wits about you and ensure you do not declare any of your personal details, particularly bank account details to any suspicious callers, letters or emails. Take a moment and ask yourself "is this for real?".

The ATO have set up a list of cyber security tips to assist in keeping your business safe. The top three tips are;

- ensure your passwords are strong and secure

- remove system access from people who no longer need it

- ensure all devices have the latest available security updates

Click on the link below to find more in depth details and tips to protect yourself, staff and clients safe form cyber scams;

The ATO have also provided further information to assist you protect your business from identity theft;

The most current scam doing the rounds is below. Be Aware!

Good Record Keeping Tips.

Get off to a good start this financial year and adopt good record keeping practices for your business. Short term pain for long term gain!

Here are some top tips to ensure you get off to a great start.

- Keep all business records including income, expenses, bank and other goods and services tax (GST) records for five years (although some records need to be kept longer).

- Records must contain enough information to calculate and support amounts claimed on activity statements and tax returns.

- Business records need to include all cash, online, EFTPOS, bank statements, credit and debit card transactions.

- Check the tax invoices received for purchases that include GST are valid.

- Keep records that show when business purchases were used for private purposes – this will help work out the business portion that can be claimed as a deduction.

- Keep business records separate from personal records to avoid confusion.

- Take pictures of paper receipts to avoid faded records.

- Store a copy of all records electronically and have a backup system in place, where possible.

- If changes were made to the record keeping software used during the year, check that all information transferred over correctly.

There are various record keeping tools available to assist you develop efficient record keeping practices. We can help you find one to suit your needs.........

As a Professional Partner of QuickBooks, did you now we offer QuickBooks online subscriptions for as little as $5.50 per month!? Make preparing for tax time and meeting tax obligations easy. Stay ahead of the game. QuickBooks online can assist you with;

- Payroll

- Invoicing

- Single touch Payroll

- Secure access anytime, on any device: your data is completely secure in the cloud, allowing you to run your business from your Mac, PC, tablet or phone.

- Easily track cash flow: automate bank feeds, send quotes and invoices, track sales and expenses, scan receipts and pay employees.

- Reports and insights: create accounting reports and invite your accountant or bookkeeper and get real-time advice and be ready for tax time.

If this is something you want to find out more about? Please contact your account manager who can provide you with more information and help you with set up- every step of the way.

Due Date REMINDER for Business

Payment Summary Statements and Payment Summaries to be sent to the ATO by 14 August 2018 where you have non-arms length employees.

- use this to summarise all payments to your employees and other payees and the amounts withheld from salary and wages and other payments

- these amounts should have been reported at labels W1 and W2 on previous financial year activity statements.

REMINDER: Trading Names

Do you have a trading name? Please read below for important updates relating to the use of trading names, effective from November 2018.

Australian Securities and Investments Commission (ASIC) announced that from November 2018, all trading names, including the trading name listed against ABN's, will be removed from the ABN lookup. However, registered trading names will continue to be listed against ABN's on the ABN lookup.

If you want to continue trading under your trading name and it is not registered, you will need to register it as a business name with ASIC. You will not need to register a business name if you trade under your own name ie John Smith but you will need to have a business name if you trade under any other derivative of your name ie John Plumbing.

Unfortunately you cannot register a business name if that name is identical to one already registered. Use the check name availability search to see if the name you want is available.

We are in the process of contacting clients who fall into this category, outlining what you need to do and what happens after your name is registered. A grace period has been put in place to allow affected businesses to transition over to the new process.

Please contact us should you have any concerns relating to this. We are able to assist in the transition.

In the meantime, here are some useful links that you may wish to look at;

http://asic.gov.au/for-business/registering-a-business-name/before-you-register-a-business-name/

http://asic.gov.au/for-business/registering-a-business-name/steps-to-register-your-business-name/

QUICK BITS

Deductions for Work Related Expenses

Planning to claim deductions for work-related expenses? The ATO have a range of occupation guides to help you get your claims right.

Don't miss out – find info on deductions specific to your industry at ato.gov.au/occupations

Fuel Tax Credits Increase

Fuel tax credit rates increased on the 1st of August 2018.

If you use fuel in heavy vehicles or other machinery for your business, check the latest rates at ato.gov.au/fueltaxcreditrates

Lost Super?

With $17 billion sitting in lost and unclaimed super accounts across Australia, you could find some too! Log into your myGov account to check, or learn more at ato.gov.au/checkyoursuper

Out Of Interest

Teaching Resources

ASIC's Money Smart AU have released a tool to assist us teach young children to save and learn about money.

Teachers and parents can use ASIC's Money Smart AU to teach children how to manage money and plan and save for the future

Check it out;

https://www.moneysmart.gov.au/teaching/teaching-resources#

ASIC's Money Smart also offer some handy calculators which are worth keeping in the memory bank. Calculators include; budget planners, super calculators, mortgage calculators, retirement planners and more.

You can check them out here;

https://www.moneysmart.gov.au/tools-and-resources/calculators-and-apps

Are you Making Money from a Hobby?

There are key differences between a hobby and business for tax and legal purposes.

Find out if you've got a business on your hands! http://bit.ly/2bZjUbe

The Personal Finance Roadmap and the Age of Distractions

Distractions are ever present in our daily lives. This may be more so the case than any other point in our history due to the emergence and development of the digital information age.

Unfortunately, depending on the context, this redirection of attention and concentration, even if momentary, can sometimes have serious short, medium and long-term implications.

This is especially relevant when considering your personal finances and staying on the path towards the achievement of your financial goals and objectives.

Have a look at this article from MHP Private Wealth's Knowledge Centre and learn how not to let distraction deter you from your path towards achievement.

http://www.mhpwealth.financialknowledgecentre.com.au/kcarticles.php?id=1811

Please contact us for any clarification on any tax matters or issues pertaining to your individual circumstances.

Be sure to check out the links below and keep up to date with the due dates for your tax obligations.

We'll be back in October!

Kind Regards

The Team

McDonnell Hume Partners

www.mhpartners.com.au

Key Dates

You can keep up to date with important accounting and business dates and deadlines. More...

Tax Facts

The Tax Facts section where you can learn more about tax requirements within New Zealand. More...

Calculators

Try out our new online calculators. More...

Request Appointments

You can also organise an appointment with one of our staff via our special online appointment form. This is particularly useful if you struggle to find the time during normal business hours to phone. Simply click here to book an appointment.