You are here:Home >Newsletters>Archives

MHP NEWS

April 2020

We hope you all had a Happy Easter and enjoyed the extra couple of days off.

The 2019-2020 federal budget has been released! In our MHP Insights section of our newsletter, we have summarised the changes that are most likely to impact you. While these changes are not yet law, it's important to know how you may be affected.

As well as the budget, in this edition of MHP News we are also covering some of the following topics;

- 15 May Due Date

- Rental Property Audits

- Taxable Payments Annual Reports

We will be back in June...... almost the end of another tax year.

MHP Insights

2019/20 Budget

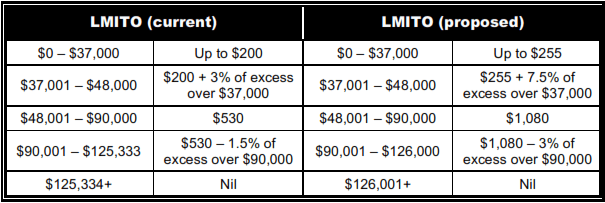

The Low to Middle Income Tax Offset (LMITO)

The Low and Middle Income Tax Offset (LMITO) is a non-refundable tax offset that affects Australian residents with a gross annual income of less than $125,334. This offset applies in addition to the Low Income Tax Offset (LITO) which has a maximum of $445.

The current and proposed offsets are as follows:

Be sure to get your 2019 information in to our firm to receive the offset as soon as possible.

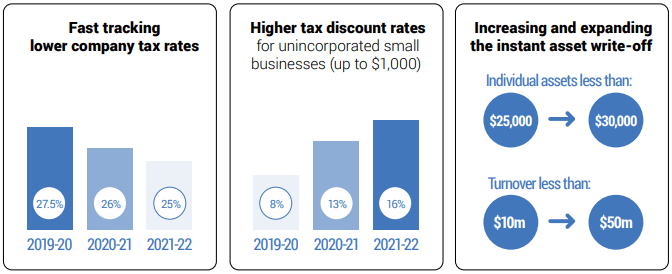

SBE Instant Asset Write-off

The instant asset write off threshold has seen multiple change during the 2019 income tax year, as follows;

- 1 July 2018 to 28 January 2019 $20,000

- 29 January 2019 to 7.30pm (AEDT) 2 April 2019 $25,000

- 7.30pm (AEDT) 2 April 2019 to 30 June 2019 $30,000

The increase to $30,000 has been legislated to continue through to 30 June 2020.

As before, the thresholds are on an asset by asset basis and are GST exclusive if your business is registered for GST or GST inclusive if your business is not registered for GST.

The immediate write off rules apply to both new and used assets.

Assets which are above these thresholds will be depreciated at a rate of 15% in the first year and 30% each year thereafter.

ABN Black Economy

The government is also tightening its grip on the black economy by providing $1 billion to extend the operation and coverage of the ATO's taskforce which will decrease the amount of unpaid tax and strengthen the ABN system. The government is making ABN holders lodge their annual tax returns and update their ABN details annually to increase compliance and data accuracy.

Medicare Levy Low Income Thresholds

The government is also going to increase the Medicare levy low income thresholds for singles, families and seniors/ pensioners. The threshold for singles was $21,980 but will be changed to $22,398. The threshold for a family was $37,098 and is becoming $37,794. The threshold for seniors/pensioners who are single was $34,758 and will change to $35,418. The threshold to seniors/pensioners with family will be increased from $48,385 to $49,304 and each dependent child or student, will increase the family thresholds by $3,471.

Bibliography Figure 1:National Tax and Accountants' Association. (2019). 2019/20 Federal Budget. Available: https://ntaa.com.au/media/news. Last accessed 24/4/19.Figure 2:Commonwealth of Australia. (2019). Budget 2019-20 Overview Glossy.Available: https://www.budget.gov.au/2019-20/content/download/overview.pdf. Last accessed 24/4/19.Australian Broadcasting Corporation. (2019). Federal Election 2019.Available: https://www.abc.net.au/news/2019-04-02/federal-budget-2019-winners-and-losers/10939098. Last accessed 24/4/19.

Tax Time 2018/2019

15 May 2019 Due Date

The 15 May deadline is fast approaching. In fact, it's only about 3 weeks away. If you have not lodged your 2018 tax return then you need to!

You must lodge (and pay where applicable) your 2018 tax returns by 15 May if;

- you have not already lodged and are not eligible for the 5 June 2019 concession.

- you are a company or super fund in this group you also need to pay on this date (if required).

Note: Individuals and trusts in this category pay as advised on their notice of assessment.

If this is you, we need your tax information NOW!

Remember........................................ the ATO imposes fees for late lodgement of your income tax returns.

Call us if you are unsure if you fit in this category, we can quickly let you know!

Rental Property Audits

The ATO is going to double the number of audits it conducts on rental properties, cracking down on dodgy rental deductions.

Of particular interest to the ATO is how rental property owners are:

- Claiming their interest expenses..........Did you know that when claiming rental interest deductions, you can only claim the interest expense on the portion of the loan that relates to the rental property and not on any amount used for private purposes?

- Deducting capital works and repairs........... Did yo know that repairs and maintenance are deductible immediately but improvements and renos may be are claimed over a number of years?

- Treating holiday homes.......... Did you know that a holiday home is generally a private asset you use for family holidays for which you cannot claim expense deductions?

- Keeping records........... If you want the deduction make sure you have the evidence to support your claim!

More information is available from the ATO in the links below. There is a short video that may be of interest and another link directing you information pertaining to rental properties.

Taxable Payments Annual Report TPAR

A taxable payments annual report or TPAR is a report that tells the ATO if you have made payments to contractors for providing services. Contractors can include; subcontractors, consultants, independent contractors and can be sole traders, companies partnerships or trusts

TPAR is an annual report, usually due to the ATO by the 28th August each year (for the previous tax year).

If you fit into one of the following industries then you will most likely need to lodge a TPAR:

- Building and constructions services,

- Cleaning services,

- Courier services,

- Road freight services,

- Information technology services,

- Security, investigation or surveillance services or;

- Some Government entities.

Details needed for the report should be found on the contractor's invoice you would have received from them. These details include;

- ABN,

- Name and address,

- Gross amount you paid to them for the financial year (including GST).

The ATO use TPAR reports to help them identify contractors who may not have met their tax obligations.

For example;

- If they have declared all of their income in their tax return,

- Not lodged tax returns or activity statements,

- Not registered for GST when they were required to and

- Quoted the wrong ABN on their invoices.

For more information on TPAR visit the ATO here https://www.ato.gov.au/Business/Reports-and-returns/Taxable-payments-annual-report/

ATO QUICK BITS

Super Guarantee Payments

Super guarantee payments are due to your employees' super funds by Sunday 28 April. As this falls on a weekend, you have until the next business day to get it done.

For more info, visit www.ato.gov.au/…/Paying-super-contributio…/When-to-pay-super

Single Touch Payroll

Only a few months left to transition to Single Touch Payroll!

You will need to start reporting the following information through an STP ready solution ie a payroll software

- payments to employees such as salaries and wages

- pay as you go (PAYG) withholding

- super information.

The way you pay your employees won't change, however you will need to send this information to the ATO each time you pay your employees.

Take the next step now so you're ready to start reporting between 1 July and 30 September.

Use the ATO's checklist to prepare: www.ato.gov.au/…/Singl…/Get-ready-for-Single-Touch-Payroll/…

If you need assistance with the transition to the ATO's new Single Touch Payroll initiative please contact us now. We can help find a suitable and inexpensive software to assist you meet these new reporting obligations.

Buying and Selling Property?

Thinking of buying and selling property for profit?

You may need to register for GST (even if you're not in business) if:

• the turnover from your transactions is more than $75K

• your activities are regarded as an enterprise.

For more info, visit www.ato.gov.au/…/…/your-industry/property/gst-and-property/…

Declaring all your income on in your tax return

One thing we've noticed in prior year returns, is some people forget to record all that they earn.

Your income is key, but it's not just your wages. Don't forget allowances and government payments!

- Interest from your bank is an absolute must. So is income from partnerships, units and trusts.

- Let us not forget earnings from far away shores – foreign income you earn must be noted as yours.

For details on what to declare visit here www.ato.gov.au/…/Income-and-deducti…/Income-you-must-declare

Primary Producer Update

Primary producers may now be able to deduct the full cost of fodder storage assets. These assets can include:

• silos

• liquid feed supplement storage tanks

• bins for storing dried grain

• hay and grain storage sheds.

Get the details at www.ato.gov.au/…/capital-…/fencing-and-fodder-storage-assets

ATO SCAMMERS- BEWARE

It's a busy time for scammers as we get closer to tax time. Stay scam savvy and follow our tips.

Tip 1 Know the status of your tax and super affairs! It may sound simple, but you're less likely to fall victim to a scam if you're aware of any refunds, debts and lodgments due. Chat with your tax agent or log into our online services to check your details.

Tip 2 Stay safe online by logging into our online services through our website or ATO app – never via links in emails. For added security, update your myGov sign-in option so you receive SMS codes.

Tip 3 Help protect your family and friends, especially older relatives! Warn them about tax scams and tactics so they don't get tricked into paying money or sharing their personal info.

See more tips at www.ato.gov.au/General/Online-services/Online-security

Out Of Interest

A Minimalist approach to personal finance

In this somewhat direct, but rather thought-provoking video shared by MHP Private Wealth, Matt D'Avella shares how minimalism helped him with his personal finances – although focused on debt management, it's a good reminder of some overall personal finance basics:

- Have open and honest conversations about money.

- Improve upon your financial literacy.

- Avoid lifestyle creep and the myth of 'I don't have'.

- Question your want purchases and the 'Joneses' mentality.

- Make sacrifices to focus on the things that add value to your life

To watch this video and read more follow this link to MHP Private Wealth's latest article.

https://mhpwealth.financialknowledgecentre.com.au/kcvideos.php?id=1066

Do you have enough stashed away as an emergency buffer?

Follow the link to MHP Private Wealth's article and video on Establishing an emergency buffer and whether you have enough savings at hand to weather a financial emergency. Whether it be medical, home, car, losing your job or investment property, an emergency buffer is essential.

https://mhpwealth.financialknowledgecentre.com.au/kcvideos.php?id=1083

Please contact us for any clarification on any tax matters or issues pertaining to your individual circumstances.

Be sure to check out the links below and keep up to date with the due dates for your tax obligations.

We'll be back in June!

Kind Regards

The Team

McDonnell Hume Partners

www.mhpartners.com.au

Key Dates

You can keep up to date with important accounting and business dates and deadlines. More...

Tax Facts

The Tax Facts section where you can learn more about tax requirements within New Zealand. More...

Calculators

Try out our new online calculators. More...

Request Appointments

You can also organise an appointment with one of our staff via our special online appointment form. This is particularly useful if you struggle to find the time during normal business hours to phone. Simply click here to book an appointment.