You are here:Home >Newsletters>Archives

MHP NEWS

December 2019

It been quite a while since our last newsletter and we're back just in time for the silly season!

Next year our newsletters will be reaching you on a quarterly basis; March, June, September and December. This will bring you more targeted information and news relevant to the tax quarters.

In House Tidbits

It's been a busy few months here at the office, with some new staff arriving and others heading off on maternity leave and new endeavours.

We welcomed Dianne to our administration team in August and said farewell to Brodie. Dianne is the new face you will see in our reception area. Be sure to say hi!

Simone is now on maternity leave and we will welcome her back sometime in 2020. Simone and Byron welcomed little Charlotte to the world in early December.

With Christmas fast approaching we wish to advise that our office will be closed from Monday the 23rd December 2019 and will re open on Monday the 6th of January 2020.

We would like to take this opportunity to thank our clients for a wonderful year and wish you all a festive Christmas and prosperous 2020.

Tax Time 2019/2020

We are almost half way through the tax year already. If you are planning on any new ventures in the new year, be sure to contact us to help you through any of your personal or business changes.

See below for all the latest tax and accounting news and information. Should you have any questions or queries relating to any of the following information please give us a call to assist you understand your obligations and any changes.

ATO Correspondence

Over the last few months the ATO have been very proactive in moving to a paperless organisation. As a result, more and more of the correspondence relating to our clients is reaching us electronically or in some cases not reaching us at all. Some clients have also been receiving their ATO correspondence directly through their MyGov accounts and SMS, bypassing tax agents all together. While we fully support the transition to a paperless society, we still need to make sure our clients are being serviced and understand the correspondence they receive. Accordingly, we always check and assess notices of assessments and all the other various ATO notices making sure you not only receive these but, also understand what you are receiving. Rest assure we have put controls in place to make sure nothing is missed.

However, it's important to note that if you have a MyGov account and you have previously lodged an activity statement or similar electronically, it is more than likely you will receive this ATO correspondence direct. While we are able to capture most of this correspondence, if you fit into this category, we will often not receive your activity statement on your behalf. If you prefer that we do receive these directly, please let us know as we have the option revert your delivery method to paper which will ensure we receive them on your behalf.

If you receive any correspondence directly from the ATO and you do not understand what you are receiving please give us a call to help you out.

MHP Client Portal

We have recently initiated our MHP Client Portal and are slowly introducing it to our clients. Our Client Portal is a convenient and secure way of transferring documents to you and from you. Rather than having to physically transfer documents via post or email, you can simply upload to your personal MHP Client Portal. Documents can be downloaded, viewed and even electronically signed.

The portal is providing a quick and easy transition of documents and tax returns to and from our clients. We have had great success so far with the clients we have invited to use the portal.

At this point in time find it is best suited to our individual clients.

While this is proving quick and easy for our individual clients it is also assisting with our goal to become a paperless office.

If this is something you think may interest you please contact your accountant to get you started!

Work Christmas Parties and Gifts

'Tis the season to be jolly! But ho-ho-hold up before you start making spirits bright and rewarding your employees with gifts or parties this Christmas, as fringe benefits tax may apply when providing all the trimmings.

So you don't get your tinsel in a tangle for your work Christmas party, consider:

- how much it costs

- where and when it is held - a party held on work premises on a normal work day is treated differently to an event outside of work

- who is invited - is it just employees or are partners, clients or suppliers also invited?

Similarly, where you provide Christmas gifts, you'll need to consider:

- the amount you spend

- the type of gift - gifts such as wine or hampers are treated differently to gifts like tickets to a movie or sporting event

- who you are giving the gift to - there are different rules for employees and clients/suppliers.

Lean more here:

Fringe benefits tax and Christmas parties

Single Touch Payroll (STP) Starts 1 July- are you ready?

As you are now most likely aware Single Touch Payroll (STP) will be required for all employers from 1 July 2019.

This means that from 1 July 2019 each and every payroll you process, you need to report the details of the your employees tax and super to the ATO from your accounting software.

If you have payroll software you need to talk to your software provider to find out if your product is ready. If you don't have a payroll software solution, give us a call to assist you be STP ready.

With STP you need to;

- Pay your employees as normal and issue a payslip

- Use your STP enabled payroll software to send a report to the ATO which includes details of salaries, wages and PAYGW and super.

The process of reporting payroll information to the ATO differs slightly between software providers. If you are unsure of how your software utilises STP then you will need to contact them for instructions or training. Alternative we can assist.

With STP, employers will no longer need to complete payment summaries and group certificates at the end of the financial year. It will be reported to the ATO every time you pay your employees. And employees are able to access this information through their myGOv in real time.

Australian Taxation Office. (2019). Work Christmas Parties and Gifts. Available: https://www.ato.gov.au/Business/Business-bulletins-newsroom/Employer-information/Work-Christmas-parties-and-gifts/. Last accessed 10/12/19.

Buying, Selling or Developing property?

You're required to register for GST if:

your activities are regarded as an enterprise, and

- turnover from your property transactions (and other transactions) is more than the $75,000 GST registration threshold.

Your activities may be regarded as an enterprise (even one-off transactions) if you:

- sell new residential property or potential residential land

- buy land with the intention of developing it for resale at a profit

- develop a property to sell.

When completing your activity statements, remember to include GST in the price you charge for certain property transactions.

You may also claim credits for the GST included in the price of goods and services you buy for your business.

For more details please follow the links below or contact our office and speak to your accountant for clarification.

Property and registering for GST

Australian Taxation Office. (2019). Buying, Selling or Developing Property. Available: https://www.ato.gov.au/Newsroom/smallbusiness/GST-and-excise/Buying,-selling-or-developing-property-/. Last accessed 10/12/19.

Hire a Trainee, Apprentice, Labourer or TA?

Deciding if your worker is an employee or contractor for tax and super comes down to asking all the right questions and weighing up the circumstances of your working arrangement with them.

But sometimes there's nothing to ask - some workers are always employees. Apprentices, trainees, labourers and trades assistants fall into this category.

The nature of their agreement with you is one of employee to employer. They aren't running their own business and you provide both instruction and supervision for the work they perform for you.

Even if they have an ABN, or have been a contractor before, you'll risk charges and penalties for your business if you treat them as a contractor.

You'll need to meet the same tax and super obligations for them as you do for any other employees of your business - Check out the ATO's handy checklist below.

Australian Taxation Office. (2019). Hire a Trainee, Apprentice, Labourer or TA. Available: https://www.ato.gov.au/Newsroom/smallbusiness/Employers/Hire-a-trainee,-apprentice,-labourer-or-TA-/. Last accessed 10/12/19.

Too Good to be True?

Heard about a tax arrangement that sounds too good to be true?

Tax planning is acceptable, as long as it's within the intent of the law. But sometimes dodgy promoters recommend arrangements that involve the deliberate avoidance of tax.

Be on the lookout for promoters who:

- tell you their product is 'zero risk'

- discourage you from seeking independent advice

- ask you to maintain secrecy to protect the arrangement from rival firms.

The way an arrangement is financed and structured can also raise red flags, such as:

- investments primarily funded through tax deductions, such as substantial interest pre-payments in a financial year

- deferring income to later tax periods

- changing private expenses into business expenses

- moving taxable income to an entity that is tax exempt or has a lower tax rate, like a charity, company or super fund.

It pays to be careful. If you're caught up in a tax exploitation scheme, it could result in additional tax and financial penalties.

If you see a tax scheme that seems suspect, or you think you might be involved in a scheme, make a tip-off to us.

Remember, we are a registered tax agent and can help you with your tax.

Click on these links to learn more.

Check before you commit to an arrangement

Australian Taxation Office. (2019). Too Good to be True. Available: https://www.ato.gov.au/Newsro?om/smallbusiness/General/Too-good-to-be-true-/. Last accessed 10/12/19.

QUICK BITS

Employers: It's time to start reporting through Single Touch Payroll.

- You can choose a pathway depending your circumstances. You either need to:

Start reporting now - Consider a quarterly reporting concession (if you're eligible)...

- Apply for more time

For more info about which option is best for you, visit www.ato.gov.au/…/Single-Tou…/Start-reporting/STP-checklists/

Tax tip: If you claim work-related expenses on your tax return, keep records to support your deductions for five years after you lodge. You could be asked to provide them later on.

- Storing your records is made easy with our ATO app, so you don't have to worry about lost or faded receipts! You can use the app's myDeductions tool to keep an electronic copy of your records that's easy to back up and store safely. Find out how and download the app at www.ato.gov.au/General/Online-services/ATO-app/myDeductions/?

If you or someone you know has been affected by the recent catastrophic bushfires in New South Wales and Queensland, tax help is at hand.

Read more about the support available for both individuals and businesses at www.ato.gov.au/…/Specific-disasters/Bushfires-November-2019/ We'll automatically update any lodgment and payment due dates on your behalf, so you don't need to take any action right now. If you have any questions or would like to discuss your options, phone us on 1800806218 for tailored support.

Did you know that there's $20.8 billion in lost super across Australia?

If you've changed your name, address, job or lived overseas, you have may some lost super waiting to be found ????

Start your hunt at www.ato.gov.au/…/Super…/Lost-and-unclaimed-super-by-postcode

Feeling charitable in the lead up to the festive season?

Whether you're digging deep to support your fave charity or dropping five bucks into a donation bucket, hang onto those receipts! You might be able to claim a deduction next tax time.

For your donation to be deductible, it must be for $2 or more and made to what's called a 'deductible gift recipient' (DGR). Check the list of approved DGRs and read more about claiming gifts and donations at

www.ato.gov.au/…/deduc…/other-deductions/gifts-and-donations

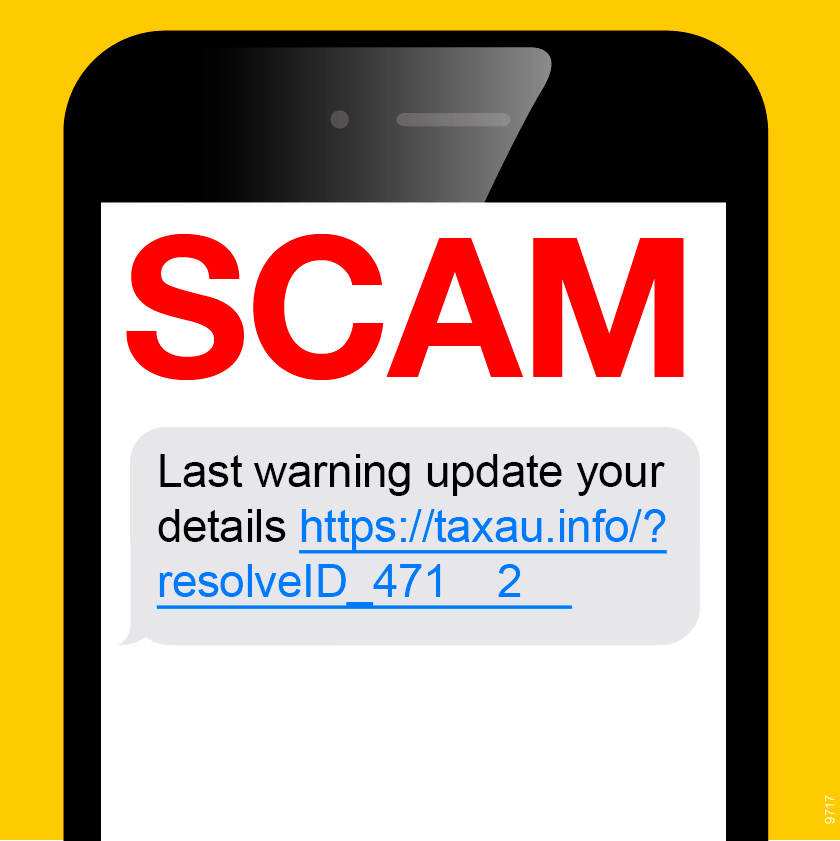

SCAM ALERT Be on the lookout for a new text message (SMS) scam asking people to update their details on a fake myGov website. Don't click any links directing you to log on, even if it looks convincing.

We will never send an SMS asking you to access our online services via a hyperlink. Warn your friends and family, and visit our scam alerts page to learn more: www.ato.gov.au/…/Online-servi…/Identity-security/Scam-alerts

Small Business Superannuation Clearing House (SBSCH)- Update

The SBSCH will be unavailable for the period 4 December 2019-1 January 2020 (inclusive) due to annual closure.

If Superannuation payments are made between the 17th and 24th December, payments will be accepted but will not be processed until the 2nd January 2019.

Please note that superannuation guarantee payments for the September 2019 - December 2019 Quarter are due by 28 January 22020.

Australian Taxation Office. (2019). Facebook Updates. Available: https://www.facebook.com/atogovau. Last accessed 10/12/19.

Out Of Interest

Getting Ahead financially: Household financial waste

Unnecessary and avoidable household financial waste can be costly; placing pressure on your cashflow, locking away potential surplus income, and prolonging the achievement of your financial goals and objectives. A household's annual food waste bill is $1,645.64 on average. Whilst this may not seem like much money to some of us, it's important to remember this is an expense, which, if left unresolved, can be quite impactful over time – especially when considering opportunity cost.This unnecessary and avoidable expense (like many others) can be eliminated in full, or at least in part, by taking a proactive approach; recognising and dealing with the relevant issues at hand on an ongoing basis.

Once this expense has been resolved, the resultant surplus income that has been unlocked can then be directed towards beneficial focuses, such as paying down debt or saving and investing for the future.

Click on the article below published by MHP Private Wealth's knowledge Center and find out how you can eliminate household financial waste.

https://financialknowledgecentre.com.au/kcarticles.php?id=2510

Financial Knowledge Centre. (2019). Getting Ahead financially: Household financial Waste. Available: https://financialknowledgecentre.com.au/kcarticles.php?id=2510. Last accessed 10/12/19.

Planning on Splurging at the Boxing Day Sales?

Before you think about buy now pay later services make sure you understand how they work and what fees you'll pay.

Buy now pay later payment services allow you to delay payment or pay by instalments (often fortnightly) over a period of time. Here Money Smart explains how these payment services work, what fees you'll pay and how to avoid getting into financial trouble if you're using these services

Australian Securities and Investments Commission. (2019). Buy Now Pay Later Services. Available: https://www.moneysmart.gov.au/borrowing-and-credit/other-types-of-credit/buy-now-pay-later-services?fbclid=IwAR16-lhh0CgYeOsrhuy3jjsOf8MZddOB5PVEa51Uoi3LIb6gsREBmwdjk5o. Last accessed 10/12/19.

Please contact us for any clarification on any tax matters or issues pertaining to your individual circumstances.

Be sure to check out the links below and keep up to date with the due dates for your tax obligations.

See you in March 2020

Kind Regards

The Team

McDonnell Hume Partners

www.mhpartners.com.au

Key Dates

You can keep up to date with important accounting and business dates and deadlines. More...

Tax Facts

The Tax Facts section where you can learn more about tax requirements within New Zealand. More...

Calculators

Try out our new online calculators. More...

Request Appointments

You can also organise an appointment with one of our staff via our special online appointment form. This is particularly useful if you struggle to find the time during normal business hours to phone. Simply click here to book an appointment.